So let’s keep Digital and banks aside and think a bit only on transformation, since the recent past which mankind has known transformation was one single constant from the invention of a circular rotating object called wheels to the discoveries in the field of teleportation, from reading alphabets to translating brain moments, from caves to 3D printed homes, from stone generated fire to Alexa controlled bulbs, from the compass to GPS, from steam engines to hyper loops the appetite of transforming things never reaches the boundaries and the touch of digital to this transformation had given us a jump of at least a hundred years in just a couple of decades and any one from generation Y would easily believe as they are the ones who interacted with both tape drives and blue rays, Atari’s and PS4 a circular dialer phone to 42-megapixel touch phones and thus the best to defend the existence of digital transformations.

So at this point we tend to agree that transformation is something that cannot be ignored or overlooked and hence every institution is pulling the plugs from paper racks, desktops and even printers so why should the banks stay away from capitalizing on digital transformations.

What I have noticed is that in order to kickoff the transformations banks are looking for several fintechs to provide them applications for digital customer acquisition, digital servicing, AI based offers and campaigns through the mobile app, web browsers or even a speech enabled devices like Alexa or Siri but the one thing they need to focus more is not the digital components but the digital journeys which will hit a broad spectrum of customers in a distinctive manner so the application is equally useful to all.

In order to support this fact, let me give you an example that my father would still like to visit branches even for small withdrawals or deposits or even paying a bill but my brother would not like to visit the branch even if he needs to open up an account so if such a diversity can be with in one family then the impact would be exponential over communities. But this fact can not be a show stopper for digitization and banks should focus more on how they can build distinctive journeys by targeting focused group of customers and move away from the fact of Omni channels to Opti-channels where every transaction, every set of action and every interaction should appear in most appropriate way to the accessing customer.

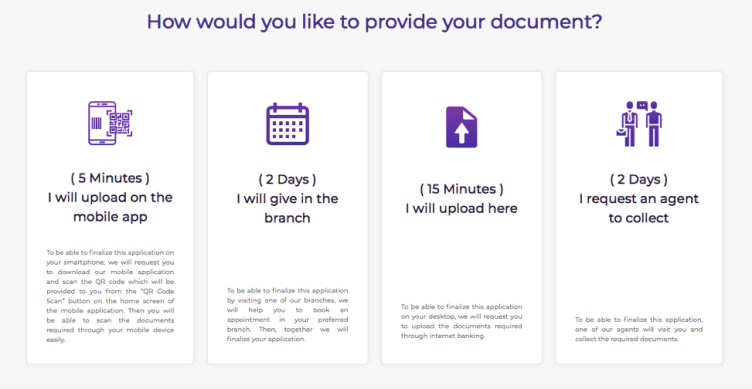

Again ill support the Opti-Channel fact by sharing a very common example of documents collection by bank for opening an account, getting a loan or even a card. So the common practice for the banks were that documents must be submitted physically in the branches but due to digitization enablement the documents needs to be snapped or uploaded from the mobile or IB and in the first scenario millennial and Gen Z will slide away while the later scenario will be almost impossible for baby boomers and early Gen X hence the document collection journey should be branched depending upon the users who are accessing the application and hence making this digitization a reality and not just a buzz word around.